- Ray Dalio, founder of Bridgewater Associates, warns that the Federal Reserve may be leading the U.S. economy into a fragile stage of its economic cycle, potentially inflating bubbles in assets like Bitcoin and gold.

- The Fed has begun cutting interest rates despite an expanding economy, which is unusual, as this typically occurs during economic downturns.

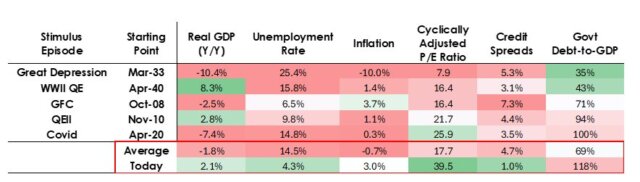

- Dalio highlights that current economic conditions differ from historical precedents, with high debt and government deficits characterizing the late stage of a long-term debt cycle.

In the world of global finance, few voices command as much attention as Ray Dalio, the billionaire investor and founder of Bridgewater Associates, one of the world’s largest hedge funds. When Dalio speaks about the economy, investors, analysts, and policymakers listen closely. Recently, Dalio issued a strong warning: the Federal Reserve may be steering the U.S. economy into the final, most fragile stage of a decades-long economic cycle, and in doing so, it could be inflating a financial bubble – especially in assets like Bitcoin and gold. Dalio’s message centers on a crucial economic shift currently unfolding in the United States. The Federal Reserve, which manages U.S. monetary policy, has begun loosening interest rates at a time when the economy is still showing signs of strength. This decision, Dalio argues, could have significant long-term consequences, including rising inflation, swelling asset prices, and increasing financial instability.

Cutting Rates in a Growing Economy

Historically, the Federal Reserve lowers interest rates during periods of economic hardship—moments when unemployment is rising, business activity is slowing, and financial markets are declining. Lower rates make borrowing cheaper, giving businesses and consumers more spending power and helping stimulate the economy. This happened during major economic downturns such as:

- The Great Depression of the 1930s

- The Financial Crisis of 2008

In both of these cases, the Federal Reserve responded to weakening economic conditions by injecting more money into the financial system. However, Dalio points out that today’s circumstances are very different. The Fed’s recent decision to cut interest rates, including the 25 basis-point reduction in October, occurred while the economy is still expanding, employment remains strong, and stock and asset markets are already elevated. This is not a typical move. And according to Dalio, it is a sign of the late stage of an economic cycle—a stage characterized by high national debt, swelling government deficits, and increased reliance on monetary stimulus.

The Final Phase of a 75-Year Economic Cycle

Dalio has long analyzed what he calls long-term debt cycles, which can last for many decades. These cycles follow a predictable pattern:

- Governments borrow to stimulate growth.

- Debt levels rise gradually.

- Economic expansion pushes asset prices higher.

- The system becomes overly dependent on cheap credit.

- Eventually, the debt becomes too large to sustain without inflation or currency devaluation.

Dalio believes the U.S. is now entering the final stage of such a cycle—a phase where governments begin to sacrifice currency stability in order to avoid economic contraction. In this environment:

- Debt grows faster than income.

- Central banks lower interest rates even when they shouldn’t.

- Asset prices inflate artificially.

The result, Dalio warns, is a dangerous environment where financial bubbles can form—especially in assets people turn to when they fear inflation.

A Growing Pressure Point

Adding another layer of concern is the U.S. government’s fiscal position. Dalio highlights that government spending is already extremely high, and the country is running large annual budget deficits. To cover these deficits, the U.S. Treasury issues debt, often through short-term bonds. If the Federal Reserve shifts to quantitative easing—a method of purchasing government bonds to support the economy—it may effectively begin funding government debt directly. This is generally seen as a last-resort measure that can weaken confidence in the currency. As more money enters the system:

- Inflation rises

- The value of the U.S. dollar declines

- Investors look for alternative stores of value

This is where Dalio sees Bitcoin and gold playing a growing role.

Bitcoin, Gold, and the Flight to Store-Value Assets

Dalio has been cautious about Bitcoin in the past. However, in recent years, he has acknowledged that digital assets like Bitcoin may serve as a store of value—especially in times of uncertainty or currency debasement. According to him, Bitcoin, gold, and similar assets become more attractive when:

- Inflation pressures rise.

- The value of currency weakens.

- Investors lose confidence in government monetary policy.

The recent rise in prices of both gold and Bitcoin reflects growing concern among investors that traditional financial systems are facing instability. To put it simply: When trust in government money decreases, trust in alternative value assets increases.

But Investors Still Wait on the Fed’s Next Move

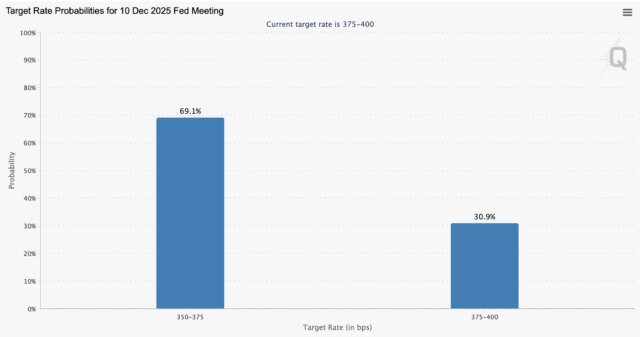

While speculative excitement grows, uncertainty remains about what the Fed will do next. Federal Reserve Chair Jerome Powell recently stated that the decision made in October does not guarantee another rate cut in December. In fact, Federal Reserve officials have expressed strongly differing views about how to proceed. However, according to market data from the Chicago Mercantile Exchange, about 69% of investors currently expect another 25 basis-point rate cut at the December meeting. Despite the October rate cut, the crypto market didn’t react strongly. Analyst Matt Mena from 21Shares explained that the move was already “priced in.” Investors had anticipated the cut long before it happened, reducing its market impact.

Ray Dalio’s cautionary message is not one to be taken lightly. His analysis suggests that the United States is moving deeper into the late stage of a long-term economic cycle, where rising debt, expansive government spending, and ongoing monetary easing could drive inflation and asset bubbles. While assets like Bitcoin and gold may benefit in the short term as investors seek safe havens, the broader financial system could face increasing instability. The Federal Reserve’s next decisions will be critical. Whether it continues to cut rates or shifts toward more aggressive monetary support, the implications will reverberate through global markets, currency valuations, and investment strategies worldwide. In an economy where confidence is the backbone of stability, Dalio’s warning underscores the importance of staying informed, diversified, and prepared for significant change ahead.

Disclaimer: CryptopianNews shares this for learning and info only. It’s not meant to be financial or investment advice. Crypto markets change a lot and move quickly. Investing in them can be risky. You should always look into things yourself. Talk to a trained financial advisor before making any choices about investing.

- Ray Dalio Raises Red Flag: Fed Fueling Financial Frenzy - November 6, 2025

- Key Conditions for Bitcoin to Escape the Bear Market - November 5, 2025

- Uphold Crypto-Backed Loans Launching in 2025 - October 28, 2025