Top Highlights

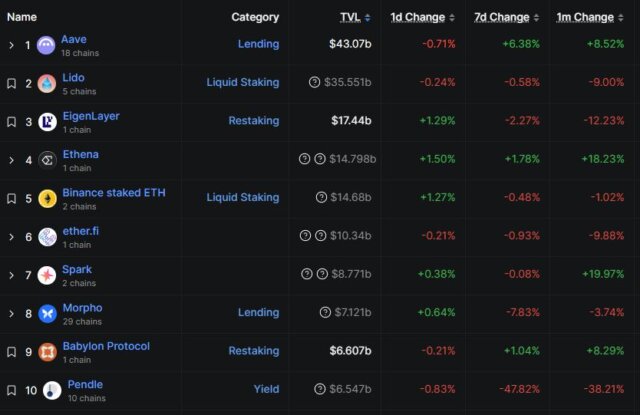

- Lido, Aave, Uniswap, EigenLayer, and Sky lead by TVL and adoption metrics in mid-2025.

- High-potential DeFi tokens 2025 to watch include Ethena, Spark, and Sky (formerly MakerDAO “Sky”).

- How to research DeFi projects: metrics like TVL, developer activity, audits, tokenomics, and community strength.

- Risk remains high: consider security, regulatory exposure, and smart contract vulnerabilities.

Bull-run is approaching, decentralized finance is evolving rapidly, and investors cannot afford to overlook its momentum. Consequently, identifying the best DeFi projects to invest in 2025 requires careful research, disciplined strategies, and a focus on sustainability. Moreover, new opportunities continue to emerge as innovations like liquid staking, restaking, and tokenized real-world assets reshape the market. This guide explores top protocols, highlights high-potential DeFi tokens 2025, and demonstrates how to research DeFi projects effectively.

Why 2025 Matters

The year 2025 represents a turning point for decentralized finance. For example, institutional adoption is growing steadily, while regulators are establishing clearer rules. As a result, projects that combine transparency and security have stronger chances of surviving. Furthermore, blockchain scaling innovations like rollups and modular chains make DeFi faster and cheaper, improving user experience. Therefore, investors must adapt their strategies to this dynamic environment.

Top DeFi Projects to Watch in 2025

Below are several protocols that balance adoption, utility, and resilience.

Lido (stETH / LSD ecosystem)

Lido remains the leader in liquid staking, which allows users to stake ETH without locking funds permanently. Moreover, in June 2025, it reported ~$22.6 billion in TVL, confirming massive adoption. Because Ethereum staking demand keeps rising, Lido continues to position itself as a core part of DeFi.

Aave

Aave is one of the oldest yet most adaptive lending platforms. For instance, as of mid-2025, its TVL reached ~$24.4 billion across multiple chains. In addition, Aave’s support for dozens of assets enhances liquidity, while its modular upgrades keep it competitive. Consequently, it remains one of the best DeFi projects to invest in 2025.

Uniswap (v4)

Uniswap, the most widely used decentralized exchange, launched v4 in 2025. Importantly, this upgrade introduced hooks, flash accounting, and lower gas fees. Therefore, it improved efficiency while boosting user adoption. In addition, Uniswap continues to dominate token swaps and liquidity pools across chains.

EigenLayer

EigenLayer is a newcomer but already transformative. Specifically, it allows Ethereum stakers to “restake” their assets for added security in other protocols. As a result, it creates new yield opportunities and reduces duplication of trust. However, risks remain high since it is still early, but upside potential is significant.

Sky (formerly MakerDAO “Sky”)

Sky, the successor of MakerDAO, has quickly gained traction in the stablecoin sector. Notably, its TVL reached ~$5.8 billion in mid-2025. Furthermore, it positions itself as a governance-driven protocol that aims to rival traditional stablecoins. Therefore, investors see it as a promising governance and stability project.

Ethena and Spark

Emerging projects such as Ethena and Spark have captured investor interest. For instance, Spark’s TVL has grown rapidly in 2025, while Ethena explores hybrid synthetic yields. Consequently, they stand out among high-potential DeFi tokens 2025. However, their risks are higher, so caution is necessary.

How to Research DeFi Projects

Knowing how to research DeFi projects is essential before committing funds. Therefore, use the following criteria.

TVL & Growth

TVL reflects the amount of capital in a protocol. If it rises consistently, it signals adoption. Moreover, compare growth across competing chains to spot real traction.

Developer Activity

Active GitHub repositories, frequent updates, and ongoing upgrades show resilience. In contrast, stagnant development is a red flag. Therefore, always review developer engagement.

Security & Audits

Audits remain non-negotiable. For example, platforms like OpenZeppelin or CertiK provide credibility. In addition, bug bounty programs encourage transparency. Consequently, audited projects are safer bets.

Tokenomics & Incentives

Study supply models, emission schedules, and utility. For instance, sustainable tokenomics reduce dumping pressure. Moreover, well-structured incentives align community and investor interests.

Governance & Community

A strong community fosters resilience during downturns. Therefore, evaluate DAO proposals, responsiveness, and user engagement. In addition, decentralized governance improves decision-making.

Risks & Mitigation

Even the best DeFi projects to invest in 2025 have risks. For example:

- Smart contract exploits remain frequent; therefore, use audited protocols.

- Regulatory uncertainty may affect stablecoins or lending tokens.

- Token inflation can dilute value if supply outpaces demand.

- Intense competition may erode market share quickly.

Consequently, diversification across sectors like staking, DEXs, and lending can reduce exposure. Moreover, investors should only commit capital they can afford to lose.

Portfolio Strategy Example

A balanced portfolio in 2025 might look like this:

| Sector | Protocol | Allocation |

|---|---|---|

| Liquid Staking | Lido | 20% |

| Lending | Aave | 15% |

| DEX | Uniswap | 10% |

| Restaking | EigenLayer | 10% |

| Governance/Stable | Sky | 10% |

| High-Potential | Ethena, Spark | 5–10% each |

Furthermore, rebalance quarterly to account for protocol changes and TVL shifts.

The best DeFi projects to invest in 2025 combine innovation, adoption, and sustainability. Projects like Lido, Aave, Uniswap, EigenLayer, and Sky remain strong anchors. At the same time, high-potential DeFi tokens 2025 such as Ethena and Spark present higher-risk, higher-reward opportunities. Moreover, applying a systematic approach to how to research DeFi projects improves your chances of success. Ultimately, diversification, active monitoring, and disciplined capital management remain the keys to thriving in decentralized finance.

Read Also: Low-Risk DeFi: Ethereum True Google Moment?

Disclaimer!! The information provided by CryptopianNews is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency markets are highly volatile and speculative, and investing in them carries inherent risks. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

- Why Stablecoins Are a Growing Threat to Traditional Bank Deposits - January 28, 2026

- Rich Dad Poor Dad Author’s Bitcoin Loss: Capital Rotation Strategy Gone Wrong - January 25, 2026

- What is Corposlop in Crypto: Vitalik Buterin’s Warning About Centralized Crypto Platforms - January 21, 2026