Bitcoin’s recent market behavior has caught the attention of traders and investors around the globe. As the price moves closer to the $107,000 mark, a growing trend of profit-taking is surfacing. This is not surprising, as many investors are opting to secure returns in anticipation of possible volatility. The current behavior is part of a broader cycle and understanding it is vital for any serious investor.

On-Chain Data Highlights Profit-Taking Trends

According to a recent report approximately 86.9% of Bitcoin holders are currently sitting on profits. Historically, when more than 85% of holders are in profit, it often signals euphoric market sentiment. This typically results in increased selling pressure as traders aim to lock in gains.

This Bitcoin profit-taking analysis reveals that, although bullish sentiment is high, a shift to caution is visible. The number of wallets selling Bitcoin on-chain has spiked, marking the highest level since December 2023. These behaviors suggest investors are preparing for potential corrections, even while price projections remain optimistic.

Potential for a Rally to $115K

Despite signs of exhaustion from short-term holders, Bitcoin could still rally to the $110,000–$115,000 range. Market analysts believe we’re entering what they call a “max pain” or “max buying” zone. This stage is often defined by increased accumulation with limited profit-taking, creating ideal conditions for upward price momentum.

With bullish technical indicators and strong momentum from long-term holders, Bitcoin’s price seems to be gearing up for a significant push. If support continues to build at current levels, breaking through psychological resistance near $115,000 becomes increasingly probable.

Implications for BTC Liquidation Levels

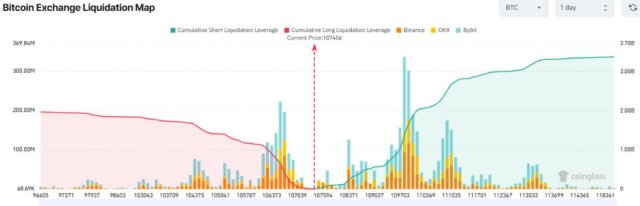

A rally to $115,000 may trigger a substantial wave of liquidations among overleveraged traders. As outlined in the article, more than $3 billion in Bitcoin short positions are likely to be liquidated above $107,000. This concentration of risk is known as a “liquidation magnet,” where the price is drawn toward levels that will force traders to exit losing positions.

BTC liquidation levels are crucial to monitor because they can dramatically impact market dynamics in a short period. As short positions get liquidated, buy orders are triggered, pushing the price even higher in a feedback loop. If Bitcoin breaks into price discovery mode beyond $110,000, the likelihood of a fast climb to $115,000 becomes more realistic.

Cryptocurrency Market Trends 2025

The cryptocurrency market in 2025 is evolving rapidly with notable shifts in investor behavior and institutional involvement. More large-scale investors are entering the space, boosting liquidity and shaping new price trends. Regulatory clarity is another driving force, as many governments are implementing well-defined frameworks for digital assets. This helps build investor confidence and reduces market uncertainty.

Technological developments are also advancing. Upgrades in blockchain scalability, security, and functionality are making platforms more efficient. These changes attract new users and improve the overall usability of cryptocurrencies. Additionally, mainstream adoption continues to grow as more businesses accept digital assets and consumers view them as viable payment methods or investment vehicles. These changes mark a clear transformation in how cryptocurrencies are used and perceived.

Strategic Considerations for Investors

Given current market dynamics, investors should approach Bitcoin and other digital assets with clear strategies. Risk management remains crucial. Using tools like stop-loss orders and diversifying portfolios helps to reduce exposure to volatility. Staying informed is another key element. Monitoring market news, analyzing on-chain data, and understanding global regulations enables better decision-making.

A long-term perspective is also beneficial. While short-term profits can be attractive, long-term investments often provide greater stability in this fast-moving market. By focusing on fundamentals and being aware of larger market shifts, investors can better navigate both opportunities and risks in the evolving crypto landscape.

Summary

While profit-taking activity is evident in today’s market, Bitcoin still holds strong potential for a push to $115,000. With historical indicators pointing to high levels of unrealized profit, and liquidation levels aligning in favor of a squeeze, upward price momentum remains a real possibility. By staying aware of market data and trends, investors can better position themselves in what continues to be one of the most dynamic asset classes of 2025.

Read Also: Bitcoin Leads as Crypto ETPs Hit $10.8B in 2025 Inflows

Disclaimer!! The information provided by CryptopianNews is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency markets are highly volatile and speculative, and investing in them carries inherent risks. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

- Why Stablecoins Are a Growing Threat to Traditional Bank Deposits - January 28, 2026

- Rich Dad Poor Dad Author’s Bitcoin Loss: Capital Rotation Strategy Gone Wrong - January 25, 2026

- What is Corposlop in Crypto: Vitalik Buterin’s Warning About Centralized Crypto Platforms - January 21, 2026