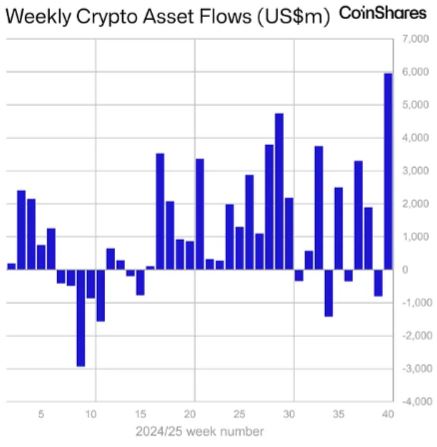

In a week that stunned markets, record crypto inflows flooded global funds as investors raced into digital assets. With weekly crypto inflows peaking at $5.95 billion, crypto investment products enjoyed their most explosive period ever. The question is: what triggered this frenzy? Below, we explore three major forces behind this landmark week—and what it means going forward.

What’s Behind the Surge?

1. Macro Tailwinds & Rate Cut Expectations

Investors had been closely watching central banks, and last week’s expectation of future rate cuts provided a powerful tailwind. The delayed reaction to the latest Fed action, combined with very weak employment numbers, spurred renewed investor appetite.

In effect, lower interest rates tend to push capital into riskier assets. In this context, digital assets became a beneficiary of fresh flows. Many buyers likely viewed cryptocurrencies as a high-reward returns play amid macro uncertainty.

2. U.S. Government Shutdown Fears Amplify Demand

Another contributor was the growing concern over a potential U.S. government shutdown. That instability created an urgency among investors—some sought a hedge against the ripple effects in traditional markets.

As a result, global crypto investment products drew capital as a form of portfolio diversification. Fear, in this case, turned into fuel for digital asset demand.

3. Strong Leadership by Bitcoin & Altcoins

Bitcoin dominated the inflow wave, drawing approximately $3.6 billion of the total.

But it wasn’t alone. Ethereum funds brought in $1.48 billion, and altcoins like Solana and XRP also posted record inflows of $706.5 million and $219.4 million respectively.

This broad-based participation suggests that investors were betting not only on Bitcoin, but on the broader crypto ecosystem. The strong showing across various digital assets added credibility to the record crypto inflows narrative.

Implications & Risks Ahead

Momentum Could Expose Volatility

While the wave of capital is exciting, it also raises the specter of sharp reversals. Inflows of this magnitude can overshoot and trigger profit-taking. Markets driven by sentiment may reverse quickly if conditions shift.

Investors should keep in mind that while weekly crypto inflows may stay elevated, sustaining this level requires steady fundamentals and macro stability.

Regulations & Policy Uncertainty

The surge comes amid ongoing regulatory ambiguity, especially in the U.S. Approvals for spot crypto ETFs, SEC decisions, and policy shifts could either magnify or derail momentum.

Any negative regulatory surprise could dampen confidence in crypto investment products or slow future inflows.

Liquidity Concentration on Major Assets

Most of the inflows landed in large-cap assets like Bitcoin and Ethereum. That concentration may leave smaller tokens vulnerable to liquidity swings. If sentiment cools, capital may retreat quickly, amplifying downside in lesser-known assets.

Measuring This Week in Context

Comparison to Previous Records

The $5.95 billion inflow eclipsed the prior high of ~$4.4 billion by more than 35%.

Before this event, digital asset funds had recently experienced minor outflows (e.g. ~$352 million outflows) during weaker sentiment.

This dramatic reversal underscores just how rare and meaningful this new peak really is.

Assets Under Management (AuM) Hit New Highs

The inflow pushed total crypto fund assets past $254.4 billion—a fresh record.

This surge in AuM is not only symbolic, but also practical: it means funds are more capable of absorbing further demand, and may justify more infrastructure and institutional interest.

Final Thoughts

This past week marked a watershed moment in crypto markets. Record crypto inflows into ETPs and investment products underscore renewed institutional confidence and a growing appetite for digital assets. While macro factors and U.S. political uncertainty served as powerful catalysts, the strength of Bitcoin and altcoins provided the foundation.

Still, this momentum is not guaranteed. Investors must stay alert to regulatory shifts, macro turns, and liquidity concentration risks. Going forward, the sustainability of such inflow levels will test whether this week becomes an anomaly—or the start of a new normal.

Read Also: Bitcoin Insights: Simon McLoughlin & Uphold’s Vision

Disclaimer!! The information provided by CryptopianNews is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency markets are highly volatile and speculative, and investing in them carries inherent risks. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

- Why Stablecoins Are a Growing Threat to Traditional Bank Deposits - January 28, 2026

- Rich Dad Poor Dad Author’s Bitcoin Loss: Capital Rotation Strategy Gone Wrong - January 25, 2026

- What is Corposlop in Crypto: Vitalik Buterin’s Warning About Centralized Crypto Platforms - January 21, 2026