Introduction to DeFi and TVL

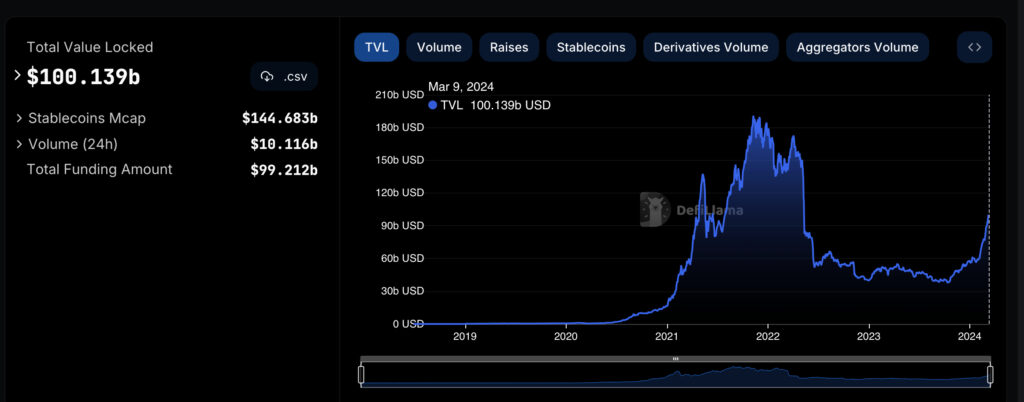

Decentralized Finance (DeFi) has emerged as a transformative force in the financial landscape, offering decentralized alternatives to traditional financial services. One crucial metric used to gauge the health and growth of the DeFi ecosystem is Total Value Locked (TVL), which represents the total value of assets locked in DeFi protocols.

Explaining TVL (Total Value Locked)

Total Value Locked (TVL) is a metric used to quantify the total value of assets locked in decentralized finance protocols. It includes assets such as cryptocurrencies, stablecoins, and other digital assets utilized within these protocols.

Factors Contributing to the Growth of DeFi TVL

Expansion of DeFi protocols

The proliferation of DeFi protocols catering to various financial services such as lending, borrowing, decentralized exchanges, and derivatives has significantly contributed to the growth of TVL.

Institutional interest

Increasing interest from institutional investors seeking exposure to the potential high yields and diversification benefits offered by DeFi protocols has led to a surge in TVL.

Yield farming opportunities

Yield farming, a practice where users leverage DeFi protocols to earn rewards or yields on their cryptocurrency holdings, has attracted a considerable amount of capital into the DeFi ecosystem, thus boosting TVL.

Impact of Bitcoin Pump on Sentiment

The recent surge in the price of Bitcoin has had a notable impact on market sentiment within the DeFi space. As Bitcoin, the leading cryptocurrency, experiences bullish momentum, it often translates into increased confidence and optimism among investors in the broader cryptocurrency market, including DeFi.

Challenges and Risks in DeFi

Despite the rapid growth and potential benefits, DeFi also presents various challenges and risks that investors and users should be aware of.

Smart contract vulnerabilities

Smart contracts, the cornerstone of DeFi protocols, are susceptible to vulnerabilities and exploits, leading to potential financial losses for users.

Regulatory uncertainty

The regulatory landscape surrounding DeFi remains ambiguous and evolving, posing regulatory risks and potential compliance challenges for DeFi projects and users.

Strategies for Mitigating Risks

To navigate the challenges and risks associated with DeFi, adopting prudent risk management strategies is essential.

Due diligence

Conduct thorough due diligence before participating in any DeFi protocol, including assessing the protocol’s security features, audit reports, and the reputation of the development team.

Diversification

Diversify your investments across multiple DeFi protocols and asset classes to mitigate the impact of potential losses from individual protocol failures or market downturns.

Insurance protocols

Explore the availability of decentralized insurance protocols within the DeFi ecosystem to protect against smart contract vulnerabilities and potential losses.

final Thoughts

The exponential growth of DeFi TVL to $100 billion underscores the increasing adoption and acceptance of decentralized finance as a viable alternative to traditional financial services. However, it is essential for participants to remain vigilant and implement robust risk management strategies to navigate the challenges and uncertainties inherent in the DeFi landscape.

WHY GALA TOKEN PRICE IS INCREASING: MAJOR DEVELOPMENTS

THE CONTROVERSY SURROUNDING WORLDCOIN’S BIOMETRIC DATA COLLECTION IN SPAIN

IS SOLANA SET TO FLIP ETHEREUM? ANALYSTS WEIGH IN

Pingback: World of Algorand: Your Guide to Blockchain Innovation