The Magic Behind Lybra Finance

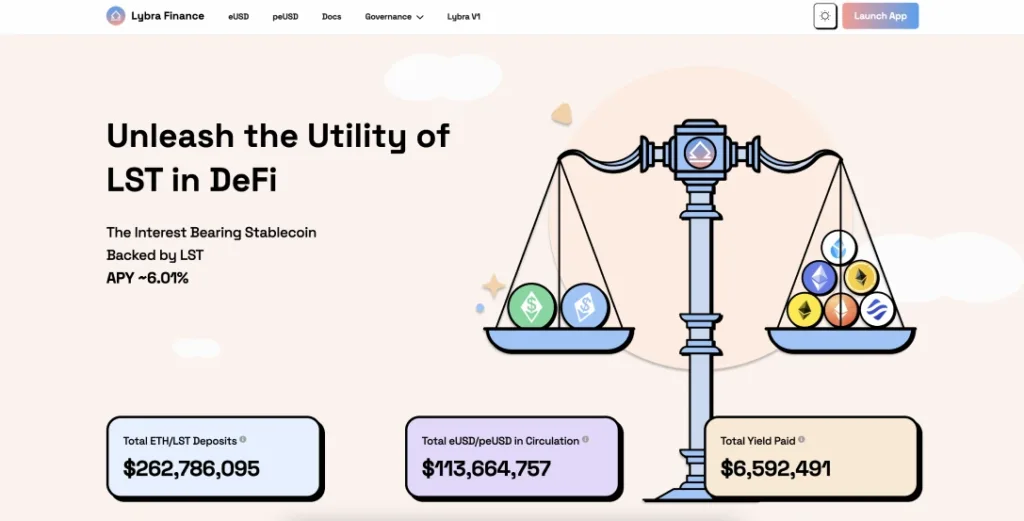

Lybra Finance is anchored in a novel concept that revolves around Liquid Staking Tokens (LSTs), primarily ETH and other proof-of-stake LSTs based on Ethereum. This setup forms the backbone for creating stablecoins like eUSD, offering security, yield, and decentralization to users.

The core of Lybra Finance is its stablecoin offerings: eUSD and peUSD. eUSD is an interest-bearing stablecoin that’s securely backed by LSTs, providing users with real-world yield. Essentially, users can mint eUSD by depositing ETH and other supported LSTs as collateral, and the structure ensures market stability.

On the other hand, peUSD, or pegged eUSD, is the omnichain version of eUSD, providing a versatile approach for various DeFi applications. It can be converted to eUSD at a 1:1 ratio and both stablecoins offer users a sense of stability and confidence, no matter what the market does.

Generating Innovative DeFi Yield

One of the coolest features of Lybra Finance Protocol is its unique way of generating real yield. When you deposit ETH or rebase LSTs and mint eUSD against these assets, you’re looking at an expected 8% APY on your eUSD holdings. This income comes from the earnings on Liquid Staking Tokens used as collateral, which is then converted into eUSD and shared with eUSD holders.

Meanwhile, peUSD lets you earn yield on your eUSD even when you spend it, offering an innovative way to manage assets in the DeFi space.

Enter Lybra V2: More Options and Flexibility

Lybra V2 expands the protocol’s capabilities by supporting a broader range of LSTs as collateral. This means more choices and flexibility for eUSD users and borrowers. The Lybra Finance DAO plays a significant role here, guiding the direction of the platform through community proposals and voting.

This adaptability ensures Lybra Finance stays on the cutting edge of DeFi while prioritizing safety and stability.

Unlocking Token Utilities

esLBR for Governance and Yield Boost

Holding esLBR tokens lets you actively shape Lybra Finance’s future by giving you a say in decisions and policies. Plus, esLBR doesn’t just grant governance rights; it also boosts your earning potential. Protocol revenues are distributed among esLBR holders, offering a steady source of income and potentially enhancing your yields.

Rewards and Fees

Lybra Finance maintains a lively ecosystem through various incentives for participants like minters, partners, and developers. These incentives include batch solution rewards, trader incentives, and ecosystem grants that keep the ecosystem thriving.

Strategic Treasury and Revenue Management

The economic model of Lybra Finance Protocol hinges on the careful management of treasury holdings, protocol revenue distribution, and strategic investments in ecosystem projects. This calculated approach ensures the ecosystem’s sustainability and continued value for users.

In a nutshell, Lybra Finance is pushing the envelope of what’s possible in the crypto world by offering innovative stablecoin options, real yield opportunities, and a range of choices for users. If you’re interested in DeFi and want to explore something fresh and exciting, keep an eye on Lybra Finance—it’s certainly a name to watch.

Behind the Price Hike of Lybra Finance

If you’ve been keeping an eye on Lybra Finance, you might have noticed a surge in the price of their tokens like eUSD and peUSD. So, what’s driving this price hike? Let’s break it down.

- 1. The Rising Demand for eUSD

As more investors catch on to the benefits of eUSD, the demand is naturally ramping up. More demand means higher prices—simple economics.

- 2. Growing Adoption and User Base

As Lybra Finance expands, its user base follows suit. More users participating in the ecosystem translates to more demand for their tokens, pushing up the prices.

- 3. Ongoing Innovations and Upgrades

Lybra Finance isn’t just resting on its laurels; they’re continuously improving their ecosystem. These enhancements and new features are drawing in more attention and, of course, driving up token prices.

Stability of eUSD

eUSD isn’t just any stablecoin. It’s designed to maintain its value and offer an attractive base annual percentage yield (APY). Thanks to being backed by liquid staking tokens (LSTs), it stays steady even in turbulent markets. This stability, paired with the interest it offers, makes it a compelling choice for investors.

The Multi-Chain and DeFi-Driven peUSD

peUSD is eUSD’s omnichain, DeFi utility version, offering similar stability and interest-bearing features. It also comes with the added bonus of functioning across multiple blockchains. This versatility and enhanced utility make peUSD a solid and valuable part of the Lybra Finance ecosystem.

How the Lybra Grant Impacts eUSD and peUSD

Lybra Finance recently granted 9,900 LBR tokens to Match Finance, a project focused on building a yield aggregator for the Lybra ecosystem. This grant supports the expansion and development of the Lybra ecosystem, which in turn boosts the value and utility of eUSD and peUSD.

Lido DAO LDO Coin Price Increase: Decoding the Surge

Why Chromia CHR Coin Price is Increasing? Key Reasons

Powerledger POWR Coin Price Increase Reasons, Key Factors

Disclaimer: The information provided by CryptopianNews is for educational and informational purposes only. It should not be considered financial or investment advice. Cryptocurrency markets are highly volatile and speculative, and investing in them carries inherent risks. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.